NV Declaration Value Form free printable template

Show details

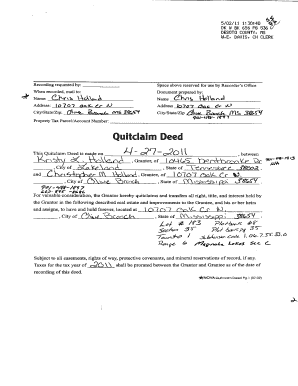

STATE OF NEVADA DECLARATION OF VALUE FORM 1. Assessor Parcel Number s a 2. Type of Property a Vacant Land b Single Fam. Res. FOR RECORDER S OPTIONAL USE ONLY c Condo/Twnhse d 2-4 Plex Book Page e Apt. Bldg f Comm l/Ind l Date of Recording g Agricultural h Mobile Home Notes Other 3. Total Value/Sales Price of Property Deed in Lieu of Foreclosure Only value of property Transfer Tax Value Real Property Transfer Tax Due 4. If Exemption Claimed a* Transfer Tax Exemption per NRS 375. 090 Section...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign clark county declaration of value form

Edit your nevada declaration value fill in form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state of nevada declaration of value form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing state of nevada declaration of value form online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit declaration value online form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out declaration of value form

How to fill out NV Declaration Value Form

01

Obtain the NV Declaration Value Form from the relevant authority or website.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal information, including your name and contact details.

04

Provide the details of the item(s) for which you are declaring value, including descriptions and values.

05

Complete any additional sections as specified (e.g., signatures, dates).

06

Review the form for accuracy and completeness.

07

Submit the form as directed, either online or by mail.

Who needs NV Declaration Value Form?

01

Individuals or businesses involved in the declaration of value for items being shipped or transferred overseas.

02

Customs agents or freight forwarders handling shipments that require valuation documentation.

03

Anyone seeking to ensure proper valuation for customs clearance and tax purposes.

Fill

declaration value pdf

: Try Risk Free

People Also Ask about state of nevada declaration of value form washoe county

What is the transfer tax in Las Vegas?

The real estate transfer tax in Clark County amounts to 0.51 percent of the sales price, meaning a $300,000 house sale produces a $1,530 tax bill.

Who signs on the state of Nevada Declaration of Value form?

It is preferred that both parties complete and sign the form as both the Seller/Grantor and Buyer/Grantee (Capacity) are jointly and severally responsible for payment of the transfer tax. If Seller/Grantor or Buyer/Grantee do not sign, the person who signs is required to identify themselves (Capacity).

Does Nevada have a real estate transfer tax?

When making a transfer of property you must complete a Declaration of Value form. You may be required to pay Real Property Transfer Tax (RPTT). RPTT is calculated as $1.95 for each $500.00 of value or fraction thereof.

Who pays real property transfer tax in Nevada?

The County Recorder in the county where the property is located is the agency responsible for the imposition and collection of the tax at the time the transfer is recorded. The Grantor and Grantee are jointly and severally liable for the payment of the tax.

What is state of Nevada Declaration of value?

The declaration of value is a document that must accompany any deed presented for recording. NRS 375.060 is the statute that pertains to this requirement and may not be waived. There are some documents that do transfer an interest in real property but are defined in statute as non-taxable.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit clark county nevada declaration of value form on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign declaration of value form nevada on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I complete nv declaration value on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your declaration value fill out, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I fill out declaration of value form on an Android device?

Use the pdfFiller mobile app to complete your declaration of value form clark county on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is NV Declaration Value Form?

The NV Declaration Value Form is a document used to declare the value of goods for customs purposes in Nevada. It serves to provide necessary information regarding the valuation of items being imported or exported.

Who is required to file NV Declaration Value Form?

Individuals or businesses that are importing or exporting goods into or out of Nevada are required to file the NV Declaration Value Form.

How to fill out NV Declaration Value Form?

To fill out the NV Declaration Value Form, include necessary identification details, a description of the goods, their value, and any applicable tariff codes. Ensure that all information is accurate and complete before submission.

What is the purpose of NV Declaration Value Form?

The purpose of the NV Declaration Value Form is to establish the declared value of goods for customs, calculate tariffs and taxes, and ensure compliance with state and federal regulations.

What information must be reported on NV Declaration Value Form?

The information that must be reported on the NV Declaration Value Form includes the description of the goods, their declared value, quantity, origin, and any relevant details pertaining to the customs classification.

Fill out your NV Declaration Value Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nevada Declaration Of Value Form is not the form you're looking for?Search for another form here.

Keywords relevant to washoe county declaration of value

Related to nevada declaration of value

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.